Featured

Table of Contents

- – The Expanding Demand for Financial Debt Forgiv...

- – Personal bankruptcy Therapy: The Misunderstood...

- – Contrasting Your Debt Alleviation Options

- – What Sets Nonprofit Counseling Apart

- – Indication of Predacious Financial Debt Allevi...

- – Taking the Initial Step Towards Recuperation

- – The Course Ahead

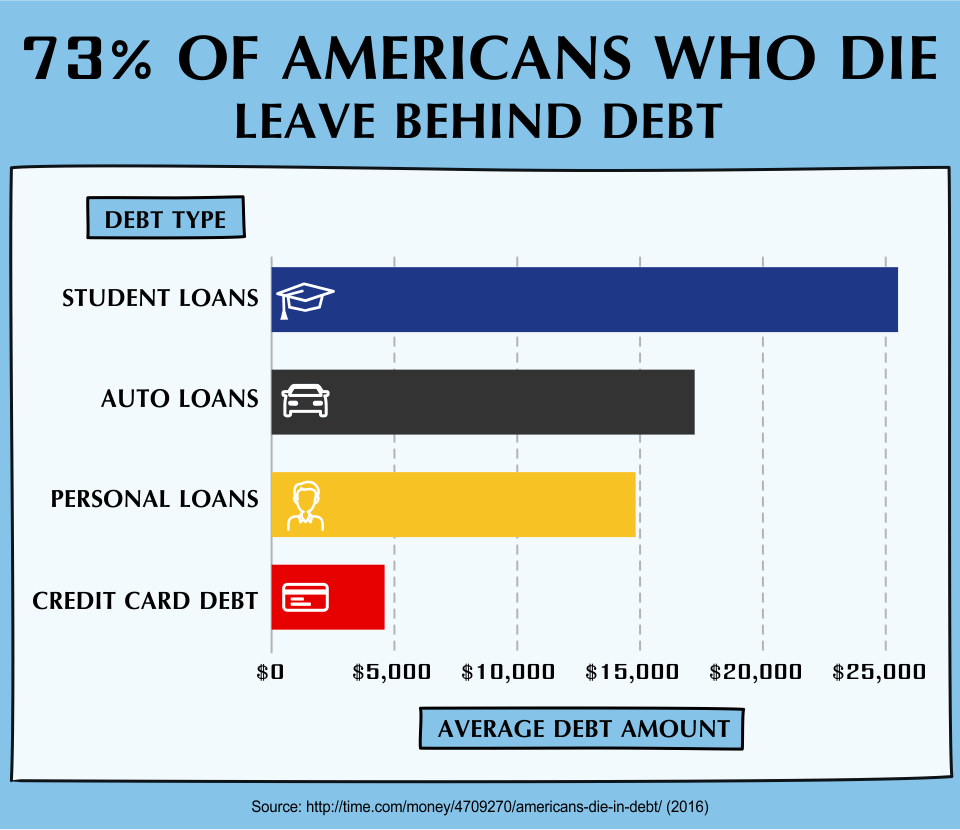

Monetary stress and anxiety has become a defining feature of modern American life. With total charge card debt going beyond $1.21 trillion and the average cardholder owing even more than $6,500, numerous people find themselves caught in cycles of minimum repayments and worsening rate of interest. When charge card rates of interest float around 23%, even small balances can balloon into overwhelming concerns within months.

For those drowning in the red, the concern isn't whether to look for help-- it's discovering the ideal sort of assistance that will not make issues worse.

The Expanding Demand for Financial Debt Forgiveness Solutions

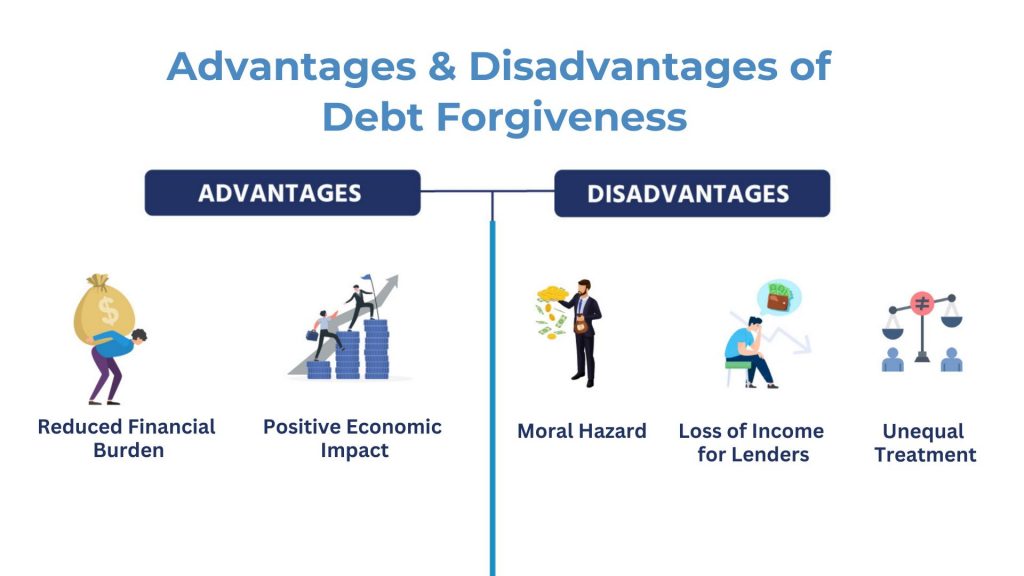

Financial debt mercy has actually arised as among one of the most browsed monetary subjects on the internet, and permanently reason. The principle of clearing up financial debts for less than the total owed offers real wish to people that see no realistic course to paying their balances in full.

The process usually works such as this: when bank card accounts go unpaid for 120 days or even more, creditors commonly bill off the financial obligation. At this stage, they might accept reduced settlements to recoup a minimum of a section of what's owed. Effective arrangements can decrease equilibriums by 30% to 50%, relying on the creditor and your shown economic challenge.

Financial debt forgiveness isn't complimentary money. Resolved accounts appear on credit score records as "" paid less than full equilibrium,"" which influences your score. Additionally, forgiven amounts exceeding $600 might be reported to the internal revenue service as gross income. Comprehending these trade-offs prior to seeking settlement is vital.

Personal bankruptcy Therapy: The Misunderstood Security Web

Insolvency lugs substantial stigma, yet it stays a genuine lawful device designed to give overwhelmed people an authentic clean slate. What numerous people don't become aware is that federal regulation needs two therapy sessions prior to and after declaring-- and these sessions exist specifically to ensure you're making a notified decision.

Pre-bankruptcy credit report counseling includes a detailed evaluation of your income, financial obligations, and expenditures. Qualified therapists existing choices you might not have actually taken into consideration, consisting of financial debt management programs or challenge negotiations. This isn't concerning preventing bankruptcy; it has to do with confirming it's absolutely your finest alternative.

Post-bankruptcy borrower education and learning prepares you for financial success after discharge. You'll learn budgeting strategies, saving approaches, and debt rebuilding approaches designed to stop future economic difficulties.

Organisations like APFSC deal both called for courses, with charges around $19.99 per session unless you receive hardship waivers. Their licensed counselors provide same-day certificates, and sessions generally run 60 to 90 minutes. This accessibility matters when you're already emphasized about financial resources.

Contrasting Your Debt Alleviation Options

Understanding the landscape of financial obligation relief aids you make notified decisions. Each approach brings distinct advantages and drawbacks.

Financial Debt Administration Programs consolidate numerous unsecured financial debts right into solitary month-to-month repayments. Counselors discuss with lenders to potentially decrease rates of interest without needing new car loans. The majority of customers full these programs within three to five years. The main advantage is paying financial debts in full while decreasing total interest paid.

Financial obligation Negotiation bargains lowered payback quantities, typically 30% to 50% much less than owed. This method needs stopping settlements to financial institutions while building up settlement funds, which damages credit rating throughout the process. Outcomes differ based on lender desire and your shown difficulty.

Insolvency gives court defense while removing or restructuring financial obligations. Phase 7 liquidates specific possessions to discharge unprotected debts swiftly. Phase 13 establishes three-to-five-year settlement prepare for those with regular income. Bankruptcy continues to be on credit history reports for seven to 10 years however uses one of the most thorough fresh start.

Debt Counseling gives education and learning and assistance without necessarily registering in official programs. Licensed counselors examine your total economic image and recommend ideal next steps, which may consist of any one of the above options.

What Sets Nonprofit Counseling Apart

The distinction between nonprofit and for-profit debt alleviation companies matters immensely. Not-for-profit companies like those certified by the National Structure for Credit History Therapy (NFCC) run under rigorous moral guidelines and fee guidelines. Their therapists go through strenuous accreditation and has to recertify every two years.

For-profit financial debt negotiation business, conversely, may charge fees varying from 15% to 25% of enrolled debt balances. Some utilize aggressive sales methods and make unrealistic promises about results. The Customer Financial Protection Bureau has actually documented numerous complaints regarding predative methods in this sector.

APFSC operates as a not-for-profit therapy firm, using cost-free financial obligation management examinations and managed fees for recurring services. Their HUD-approved housing therapists include worth for those encountering foreclosure along with general debt worries. Solutions are available in English, Spanish, and Portuguese, broadening availability to underserved areas.

Study sustains the efficiency of nonprofit therapy. A research study commissioned by the NFCC found that credit history therapy clients decreased revolving financial debt by $3,600 greater than comparison teams during the 18 months following their sessions. Virtually 70% of individuals reported better finance and better financial confidence.

Indication of Predacious Financial Debt Alleviation Solutions

Not all financial obligation alleviation business have your ideal interests in mind. Identifying warnings safeguards you from making a tough circumstance worse.

Beware of firms that guarantee specific outcomes. No genuine service can promise exact negotiation portions or timeline assurances because results rely on individual financial institutions and scenarios.

Stay clear of any firm demanding big in advance fees before offering services. Genuine nonprofit therapy offers free preliminary appointments, and for-profit negotiation firms are lawfully restricted from accumulating charges until they successfully settle at the very least one financial debt.

Question any person suggesting you to stop connecting with creditors totally without explaining the consequences. While critical communication stops briefly occasionally sustain settlements, total evasion can cause suits, wage garnishment, and added damage.

Legit companies describe all options honestly, including choices that might not entail their paid services. If a firm pushes just one remedy no matter your circumstance, look for assistance somewhere else.

Taking the Initial Step Towards Recuperation

Financial healing begins with sincere evaluation. Gather your most current statements for all financial debts, determine your overall commitments, and review your realistic month-to-month repayment capacity. This info creates the foundation for any kind of efficient therapy session.

Take into consideration scheduling free examinations with several not-for-profit firms prior to devoting to any type of program. Compare their referrals, charge frameworks, and communication designs. The right counseling partnership ought to feel encouraging rather than pressing.

Organisations like APFSC supply on-line conversation, phone consultations, and thorough intake procedures developed to recognize your unique situation before recommending remedies. Their debt administration calculator helps you visualise possible timelines and financial savings prior to signing up.

The Course Ahead

Overwhelming financial debt doesn't specify your future-- yet overlooking it will. Whether financial debt forgiveness, insolvency counseling, or structured financial debt monitoring makes good sense for your circumstance depends on aspects distinct to your situations.

Professional assistance from certified not-for-profit therapists illuminates alternatives you may never ever uncover independently. These solutions exist particularly to assist individuals like you navigate intricate financial challenges without predatory fees or unrealistic promises.

The average American battling with financial obligation waits much also lengthy prior to seeking assistance, enabling interest to compound and choices to narrow. Each month of hold-up costs cash and expands your healing timeline.

How Debt Impacts Mental and Emotional Well-BeingYour initial discussion with a qualified counselor costs nothing but could transform every little thing. Financial flexibility isn't booked for the fortunate-- it's readily available to any individual happy to take that first step toward understanding their options and committing to a practical plan.

Table of Contents

- – The Expanding Demand for Financial Debt Forgiv...

- – Personal bankruptcy Therapy: The Misunderstood...

- – Contrasting Your Debt Alleviation Options

- – What Sets Nonprofit Counseling Apart

- – Indication of Predacious Financial Debt Allevi...

- – Taking the Initial Step Towards Recuperation

- – The Course Ahead

Latest Posts

The 6-Minute Rule for Evaluating The 12 Most Common Myths About Debt Relief—Busted by Real Counselors : APFSC Providers in the Industry

The 45-Second Trick For Key Things to Ask Before Signing Up

The Ultimate Guide To Does Bankruptcy Make Sense for Everyone

More

Latest Posts

The 45-Second Trick For Key Things to Ask Before Signing Up

The Ultimate Guide To Does Bankruptcy Make Sense for Everyone